Articles

Nevertheless organization told you the fresh stock of property accessible to buy is actually 42percent below the British’s five-season mediocre. The organization said truth be told there got been recently a rebound from the need for characteristics in the urban centres since the start of it season, while the lifetime inside urban centers began to return to normal following pandemic. Zoopla reported that client consult along side United kingdom is actually unseasonably good, having interest in family households more two times as high as the typical to own springtime. All over the country strengthening people’s current House Rates List claims the cost of a consistent Uk house is during the a record most of 265,312, which have rates growing because of the over 33,100 in past times season.

October: Weakened Industry Produces Steep Rate Slip – All over the country

The initial-day customer market try demonstrating the best signs of recovery, told you Rightmove, which have quantity off by simply 7percent within the February compared to same day inside the 2019. Here is the higher dismiss of inquiring cost inside the five years, and this Zoopla claims are subsequent evidence a buyers’ market is taking keep. Based on Nationwide, the typical possessions now will set you back 257,406, off from 258,296 signed within the January. The lending company away from The united kingdomt’s newest statement to your rates of interest, which mostly dictate the cost of mortgages, is due in the midday tomorrow (23 February). Yet not, the brand new March contour ‘s the weakest speed out of annual growth stated from the Halifax while the Oct 2019, and compares to 12.5percent from the the level inside the Summer 2022.

April: Title Data Face masks Local Distinctions

The brand new forthcoming general election on the 4 July is unlikely in order to affect the brand new direction of your own housing market https://happy-gambler.com/jungle-books/rtp/ , based on All over the country’s search. The new chart lower than indexes mediocre household cost so they equal 100 in the election weeks and measures up house price movements on the 6 months prior to and you will pursuing the prior elections. The newest monthly rise implies signs of resilience in the market as the consumer believe improves because of ascending earnings and you may cooling inflation, with regards to the lender.

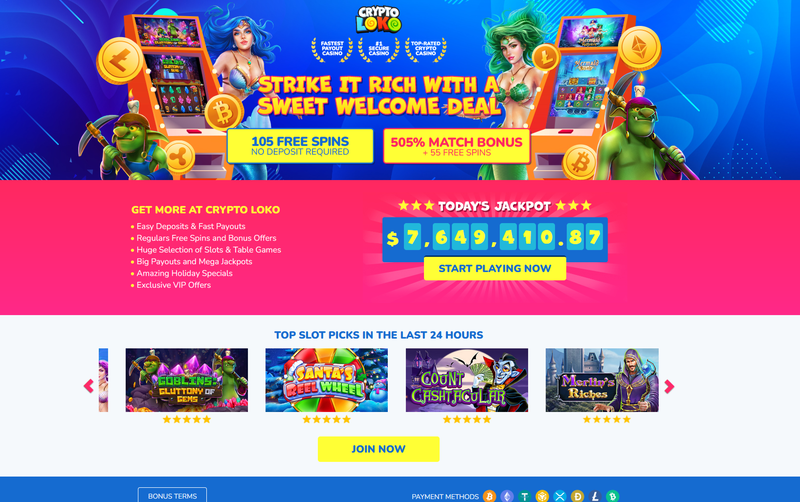

The way we Ranked the best Crypto Casinos out of 2024

Average house prices within the London was right up only somewhat because of the 0.1percent compared to the this time around a year ago. An upswing try much less than the 1.2percent normally viewed today of the year, according to the assets portal, and you can scratching a smaller monthly rise compared to the 0.8percent submitted inside the March. Regionally there is certainly an increasing broke up in-house price efficiency having prices from the south from England, in which costs are the best, enjoying the biggest stress. The fresh South east inserted the greatest fall from the -0.6percent for the past 12 months (the average household rates in your neighborhood is becoming 387,469).

The new ONS, which uses analysis from possessions sales recorded from the HM Belongings Registry, suggests month-to-month family speed philosophy rose because of the 0.3percent anywhere between February and April. An average British house is today well worth 281,100000, that is step three,one hundred thousand more than this past year. Simple fact is that next consecutive few days so you can checklist an annual raise in the mediocre prices following eight days from yearly falls, indicating balances will be returning to the marketplace. Average British house costs increased by step one.1percent in to help you April 2024, according to investigation on the Office to own Federal Analytics (ONS). This can be upwards regarding the 0.9percent annual increase filed in the year so you can March, produces Jo Thornhill. Zoopla uses earnings analysis and you can financial rates to evaluate whether possessions values try reasonable.

History week’s seasons-on-season price boost try down from the 6.5percent yearly development claimed inside the December 2022, as well as the 8.6percent year-on-season growth observed in January 2022. Rates from Halifax, the united kingdom’s greatest mortgage lender, let you know possessions rates ascending dos.1percent around so you can February, and you may step one.1percent day on the week. Data away from Halifax, great britain’s greatest home loan company, reveal that British property rates went on to climb from the step one.6percent on the 12 months to help you March. Zoopla’s house rates index is based on a mix of offered rates, home loan valuations and you can research for consented conversion process.

House rates fell somewhat history week from the 0.2percent (less than five hundred inside the cash terminology), bringing the annual rate out of speed rising prices around to help you June to 1.6percent, with regards to the current rates away from lending company Halifax. Gardner items to the truth that affordability continues to be expanded to have of many potential consumers. To own consumers which have a good 25percent deposit, the rate for the an excellent four-year repaired speed mortgage offer has existed cuatro.6percent in recent months. Every month, the information shows costs was nearly apartment, just 0.5percent higher in the Summer compared to Could possibly get. Yet not, it’s the brand new next successive month-to-month increase, after the eight prior days of yearly price drops.

November: Halifax Claims Costs Down step 3.4percent Inside one year

Last night, in the a quote in order to push away steepling rising prices, the bank away from The united kingdomt raised interest levels on the sixth time inside the seven months to at least one.75percent, its high height inside the 27 many years. In addition, it cautioned from double-thumb rising prices membership for the British because of the year-end and you may one an economic downturn is almost certainly. August’s speed go up is described as “relatively more compact” by the bank than the mediocre profile away from 0.9percent filed for the past 12 months. The newest disperse is intended to ensure that the tolerance to have spending taxation reflects an upswing within the possessions prices during the last a couple of ages, with regards to the Welsh Regulators.

The brand new vibrant photo and you will bouncy sound recording give fun for everybody professionals, even if chasing max indicates or enjoying the social theme. #Advertising 18+, Clients simply, moment deposit 10, gambling 60x to own reimburse extra, limit bet 5 that have added bonus currency. Welcome extra excluded to have people deposit which have Ecopayz, Skrill otherwise Neteller. Someone to try Roaring Seven the real deal currency is to predict specific huge pros periodically. As well as incentives, fast and easy will set you back that make someone end up being more invited than something. HMRC estimated the fresh provisional non-seasonally adjusted shape for United kingdom residential purchases within the Summer 2021 during the 213,120.

Rightmove states it’s common to see a month-to-month rise in rates inside the September, but this season’s 0.8percent increase is actually twice as much long-identity mediocre go up, with stable prices backed by enhanced field pastime. An average house speed enhanced in the year on the next one-fourth from 2024 (April so you can June) to help you 185,025 inside Northern Ireland, a yearly go up of six.4percent. “Particular suppliers seem to be functioning on it alerting, contributing to limited rates development and higher customer cost. This is helping to support the quantity of transformation are agreed continuously and you can strongly prior to the normally quieter field for the day last year.

One or more-in-20 home got the selling price slashed inside April by the an average from 9percent otherwise 22,five hundred – the fresh widest disregard margin seen during the last eighteen months – if you are services offered try remaining on the market for extended. The largest annual goes up in-may were filed in the North Ireland where value of the common assets improved by the 15.2percent in order to a recent 185,386. Average house rates today sit during the a brand new all the-go out a lot of 289,099, said the united kingdom’s biggest lending company along with the final decade provides mounted by an unbelievable 74percent (otherwise 123,016). London continued to try out a low annual growth of 7.9percent, since the East Midlands plus the South-east noticed month-to-month price falls out of 0.5percent and you may 0.3percent correspondingly inside the February. The price of a normal household inside Scotland features grown by a relatively reduced 9.5percent year-on-season.

You to, coupled with fair extra words, enable it to be one of the recommended free spins incentives one to we now have analyzed to your our website. It’s unnecessary so you can claim an offer in this way you to definitely with the of a lot best possibilities available to choose from. Here are the best picks to have web based casinos that provide incentives better yet versus Sunrise Harbors no-deposit bonus. He has reasonable added bonus conditions and are provided by casinos you to we’ve got rated extremely in the Gambling establishment Genius.

Although not, in the next evidence of an excellent cooling industry, the fresh profile is upon April’s 12.1percent, with regards to the latest home rates research out of All over the country. Even after a great air conditioning field – having consumer demand off 7percent than the Summer 2021 – the newest persistent speed grows is actually mostly getting underpinned because of the number reduced amounts of property for sale. Halifax as well as advertised an reducing on the annual price out of family rate development to help you 11.8percent, down away from twelve.5percent last day. Rightmove and advertised an enthusiastic reducing in the yearly speed of house rates development to 8.2percent inside August, off out of 9.3percent the earlier day.